Yale’s Swensen Invests in $400 Million Crypto Fund

from CNBC.

The most influential endowment manager just jumped into crypto with bets on two Silicon Valley funds

- Swensen, who manages Yale’s $29.4 billion endowment, has invested in two funds dedicated to cryptocurrencies, sources tell CNBC.

- The funds are run by Andreessen Horowitz and Paradigm, which was started by Coinbase co-founder Fred Ehrsam and former Sequoia Capital partner Matt Huang.

- The investment marks a much-needed vote of confidence for the volatile asset class.

- Swensen started at Yale in 1985 when the endowment managed just over $1 billion, according to its alumni magazine, which has also called him Yale’s “in-house Warren Buffett.”

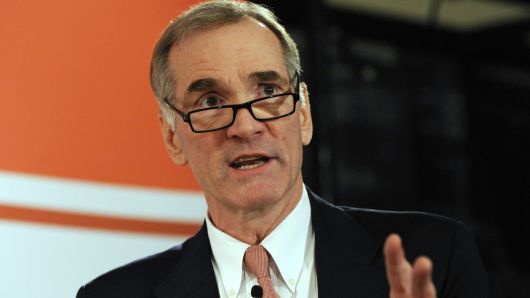

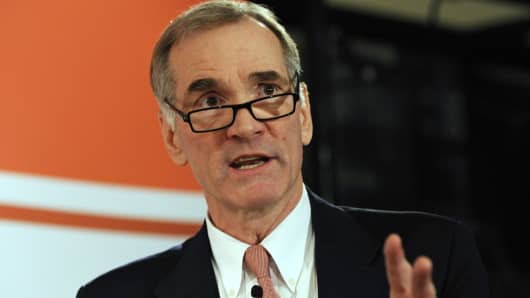

David Swensen, who’s known as Yale’s ‘Warren Buffett’ because of his investing success with the university’s endowment, is making his first big bets on cryptocurrency following the recent swoon in the price of bitcoin and other digital currencies.

Swensen, who is chief investment officer of the university’s $29.4 billion endowment, has invested in two venture funds dedicated to cryptocurrency, according to people familiar with the matter.

Swensen’s team invested in Andreessen Horowitz’s inaugural $300 million crypto fund, which closed in June, said the sources, who declined to be named because the investment was confidential. It also backed Paradigm, a new blockchain and cryptocurrency-focused fund started by Coinbase co-founder Fred Ehrsam and former Sequoia Capital partner Matt Huang, the sources said.

Representatives from Andreessen Horowitz, Paradigm and the Yale Investment Office declined to comment.

Yale’s investments represent a much-needed vote of confidence for an asset class that’s been hammered in 2018 following a historic rally last year and has yet to see the support of major endowments and foundations. Bitcoin plunged more than 50 percent this year, while the total market capitalization for all cryptocurrencies has plummeted 63 percent, according to data from CoinMarketCap.com.

Top names in finance have been skeptical. J.P. Morgan’s Jamie Dimon called the digital currency a “fraud,” Buffett likened it to “rat poison,” and Citadel’s billionaire hedge fund manager Ken Griffin compared it to the tulip mania of the 17th century.

A big challenge for venture investors is that crypto bets like tokens and digital currencies are very different from taking sizable equity stakes in start-ups, forcing risk-averse money managers to adapt to a whole new set of issues.

“People are excited about it but afraid of being the first, or having to explain themselves,” said Bill Barhydt, CEO of cryptocurrency exchange Abra. “That’s the fear vs. greed of institutional investing. There’s a herd mentality there as much as there is in retail investing.”

Last year, bitcoin surged more than 1,000 percent to a high of almost $20,000, rewarding miners and enthusiasts. But the market has been beset by news of hacks, regulatory uncertainty and failed projects, and bitcoin’s price has dropped back to around $6,500. Some 223 funds dedicated to cryptocurrency popped up in 2017, up from just 23 funds the prior year. As of Sept. 1, there were a total of 389 global cryptocurrency funds, according to the latest data from Autonomous Next.

Still, firms like Andreessen Horowitz are focused on long-term investments in the space.

Chris Dixon, who runs Andreessen Horowitz’s crypto investments along with Katie Haun, told CNBC at the fund’s launch that these are “all-weather” bets that they’ll make over time regardless of market conditions. Over two to three years, the firm will invest in everything from early-stage coins and tokens to later-stage networks like bitcoin or ethereum and will hold those investments for up to a decade.

Andreessen Horowitz was investing in crypto well before the dedicated fund, backing Coinbase in 2013. As of June, the firm said it had not sold any of its investments in crypto.

The fund is a sensible entry point for Swensen. Yale has been an investor in the firm’s previous funds as part of a portfolio that’s included investments in funds run by Benchmark and Greylock Partners.

Paradigm is a brand new firm that has not yet announced its existence, but it also has some familiar names for Swensen. Ehrsam comes from Coinbase, and Huang has been working at Sequoia, a firm that’s generated healthy returns for Yale.

The Swensen effect

Swensen is widely considered one of the world’s top money managers. His approach to institutional investing has been outlined in multiple books and has largely reshaped the way other large endowments are managed.

Swensen started at Yale in 1985 when the endowment managed just over $1 billion, according to its alumni magazine, which has also called him Yale’s “in-house Warren Buffett.” It’s now the second largest endowment, behind Harvard, investing in everything in from venture capital and buyout firms to timber.

Yale’s endowment returned an annualized 7.4 percent in the past decade and 11.8 percent over 20 years, according to its annual report. The fund gained 12.3 percent from June 2017 through June 2018, the university announced this week. Harvard University, with a $39.2 billion endowment, posted a 10 percent gain.

Crypto is a tiny allocation in Swensen’s nearly $30 billion portfolio. But if his previous strategies are any indication, it’s a good bet that a number of other endowments are poised to follow him.

WATCH: There are plenty of gimmicky cryptocurrencies and regulators helping to find the bad players